January 11, 2026 | 05:33 pm

TEMPO.CO, Jakarta - The Directorate General of Taxation (DJP) of Indonesia's Ministry of Finance supports the revocation of the practice license of a tax consultant who was involved in a bribery case and tax reduction. The tax consultant with the initials ABD, along with four other individuals, was designated as a gratification suspect that involved the North Jakarta Tax Service Office (KPP).

The Director of Education, Services, and Public Relations of the DJP, Rosmauli, stated that three tax officials who were named as suspects have been temporarily dismissed by the DJP. Meanwhile, the Directorate General of Taxation supports the revocation of ABD's license as well.

Rosmauli stated, "Regarding the external parties who have the status as a Tax Consultant, the DJP supports the enforcement of professional ethics codes and administrative sanctions in the form of revocation of the Tax Consultant's practice license by the Directorate General of Financial Sector Stability and Development, in coordination with the DJP and professional associations," in her written statement on Sunday, January 11, 2026.

Rosmauli stated that the revocation of the license can be done in accordance with the provision of the Minister of Finance Regulation Number 175 of 2022. Based on article 28, clause 1, letter g of this regulation, the freezing of practice licenses can be done when a tax consultant is designated as a suspect in criminal acts related to taxation based on information from authorized parties.

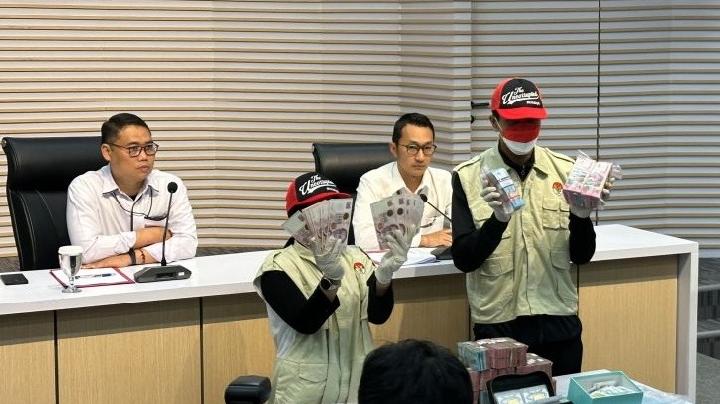

The Corruption Eradication Commission (KPK) has detained 5 bribery suspects involving the North Jakarta Tax Service Office with the company with the initials PT WP. The five individuals are the Head of the North Jakarta Tax Service Office with the initials DWB, AGS as the Head of the Supervision and Consultation Section of the North Jakarta Tax Service Office, and ASB as the Evaluator Team at the North Jakarta Tax Service Office. The other two suspects are EY as a staff member of PT WP and ABD.

The Acting Deputy Director of Enforcement and Execution of the KPK, Asep Guntur Rahayu, explained that ABD acted as a gratification distributor from PT WP to the officials of the North Jakarta Tax Service Office. The bribe money was disbursed through a company owned by ABD.

"PT WP disbursed funds with a fictitious contract scheme for financial consultation services using the company PT NBK owned by ABD as a tax consultant," said Asep during the press conference on Sunday, January 11, 2026, as quoted from the KPK Indonesia's Youtube channel.

Previously, tax officials requested Rp8 billion from PT WP as a reward or fee for the reduction of the land and building tax obligation report value from Rp75 billion to Rp15 billion. However, PT WP could only fulfill a fee of Rp4 billion.

After it was agreed upon, PT WP transferred the fee to PT NBK and recorded it as a tax consultant fee in the company's accounting. "Then in December 2025, PT NBK disbursed a commitment fee of Rp4 billion which was then exchanged into Singapore dollars," said Asep.

ABD then handed the funds over in cash to the tax officials, AGS and ASB. In January 2026, AGS and ASB distributed the money to several employees at the Directorate General of Taxation, as well as to other parties. In the distribution process, the KPK team then made the arrests.

Read: KPK Arrests Eight in North Jakarta Sting Operation

Click here to get the latest news updates from Tempo on Google News

KPK Arrests Eight in North Jakarta Sting Operation

1 hari lalu

KPK conducts a sting operation in North Jakarta, targeting eight individuals.

Indonesia's Purbaya Probes Alleged Tax Evasion by Chinese-Owned Companies

1 hari lalu

Indonesia's finance minister Purbaya says several foreign-owned firms, particularly from China, failed to pay taxes, causing major state losses.

Indonesia to Mandate Ethanol-Blended Fuel by 2028, Minister Says

2 hari lalu

Minister of Energy and Mineral Resources Bahlil has stated that President Prabowo Subianto has approved the mandatory 10 percent ethanol blend for fuel oil.

Indonesia's 2025 Tax Revenue Misses Target by Rp271 Trillion

2 hari lalu

Indonesia's 2025 tax revenue fell Rp271 trillion short of the APBN target. Deputy Finance Minister Suahasil Nazara explained why.

Indonesia's Energy and Mineral Investment Drops 1.9% in 2025

3 hari lalu

Minister of Energy and Mineral Resources noted that the realization of investment in the sector declined from US$32.3 billion in 2024 to US$31.7 billion in 2025.

Japan to Triple Departure Tax in July 2026 to Curb Overtourism

3 hari lalu

The Japanese government plans to triple departure tax and introduce a new travel fee through the JESTA system in 2028

Indonesia Publishes 2026 State Budget; Here's the Details

3 hari lalu

The Indonesian government finally publishes its 2026 State Budget for public access on Wednesday, January 7, 2026.

Purbaya Issues New Rules to Monitor Taxpayer Compliance

4 hari lalu

Finance Minister Purbaya Yudhi Sadewa issued Regulation Number 111 of 2025 in a bid to strengthen taxpayer compliance.

Over 11.19 Million Indonesian Taxpayers Activate Coretax Accounts

9 hari lalu

The Directorate General of Taxes (DJP) reported that as of January 2, 2026, there have been 11.19 million taxpayers who have activated their Coretax accounts.

Coretax Activation Guide: 4 Things Taxpayers Must Know

10 hari lalu

The Directorate General of Taxes reports over 10 million Coretax activations. Learn about the deadlines, activation steps, and how to avoid fraud.