December 23, 2024 | 10:02 am

TEMPO.CO, Jakarta - Member of the House of Representatives (DPR) of the Gerindra Party Faction, Heri Gunawan, said that PDIP does not need to play drama by pretending to defend people over the increase in value-added tax (VAT) to 12 percent. He said that PDIP's changed stance could now be seen as an opportunist stance that uses the stage for image building.

"PDIP should take a firm stance as an opposition to President Prabowo Subianto's government. Moreover, PDIP already has 10 years of experience as an opposition to the SBY government," he said in a written statement on Sunday, December 22, 2024.

Thus, he said, the political configuration in parliament will be clear, who supports the government and who is the opposition. He said, the 12 percent VAT increase was the responsibility of PDIP, which at that time was the leader in the ratification of the Tax Regulation Harmonization Law (UU HPP).

He stated that the basis for the tax increase was Article 7 Paragraph (1) of the HPP Law which mandates a VAT rate of 11 percent to be effective on April 1, 2022 and a VAT rate of 12 percent to be effective no later than January 1, 2025. Based on the provisions of the HPP Law, the increase in VAT rates was carried out in two stages, the first stage of which was carried out in 2022.

"At that time, PDIP was the most enthusiastic about conveying the VAT increase and even wanted to protect itself, so it was strange that before the implementation of the second stage, PDIP turned away and criticized harshly," he said.

He explained that the discussion of the HPP Law at level I was conducted in Commission XI of the DPR. At that time, the chairman of the working committee or Panja was a PDIP cadre, Dolfie Othniel Frederic Palit. In addition, as the largest party in the DPR, PDIP also sent the most members to Panja.

According to him, the discussion at level I was relatively smooth and almost all factions agreed to the HPP Law. Then, the discussion was continued at level II, namely at the DPR plenary meeting.

"The configuration is no different. It should be noted that at that time the DPR Speaker was also held by a PDIP cadre, Puan Maharani," said Heri.

Approaching the implementation of 12 percent VAT, he assessed that PDIP's attitude had changed 180 degrees. He said that PDIP should have been consistent with its attitude since the Commission XI Working Committee, the DPR plenary meeting, until the implementation of the first phase of the VAT increase in 2022.

"PDIP strongly criticized the policies it made in the past. This attitude shows PDIP's true attitude as an opportunist," he said.

He added that the implementation of the second phase of the VAT increase coincided with the early days of Prabowo's administration. "This condition is certainly a dilemma. However, according to his oath, President Prabowo will continue to implement the provisions of the HPP Law," said Heri.

Previously, the Speaker of the House of Representatives and Chair of the PDIP DPP Puan Maharani warned about the impact of the increase in VAT to 12 percent as of January 1, 2025. She suggested that the government listen to input from various groups, including experts, regarding the potential that could arise from the policy.

Puan did not deny that the 12 percent increase in VAT is in line with the mandate of the HPP Law. However, she said that its impact on people's purchasing power and economic growth must be calculated.

"Because there are still concerns that this policy could worsen the situation for the middle class and small business actors," said Puan in a written statement on Thursday, December 19, 2024.

She said, the policy should not make the people's economy difficult. "We must understand the conditions of the people, don't let this increase in VAT make the people's economy even more difficult."

Daniel A. Fajri contributed to the writing of this article.

Editor’s Choice: PDIP Denies Being Initiator of 12 Percent VAT: 'Jokowi Govt Proposed It'

Click here to get the latest news updates from Tempo on Google News

PDIP Denies Being Initiator of 12 Percent VAT: 'Jokowi Govt Proposed It'

11 jam lalu

The PDIP party denied allegations that the party faction proposed an increase in value-added tax (VAT) to 12 percent.

Director General of Taxes Says 12 Percent VAT Imposed on Some Goods and Services

13 jam lalu

The Indonesian govt has finally acknowledged that the increase in Value Added Tax (VAT) next year will not be selectively applied only to luxury goods

Special Rice to Be Subject to 12 Percent VAT

15 jam lalu

Special rice is likely to be subject to Value-Added Tax (VAT) of 12 percent starting next year in Indonesia.

QRIS Not Subject to 12 Percent VAT, Says Coordinating Minister

17 jam lalu

Coordinating Minister for Economic Affairs Airlangga Hartarto said that electronic money transactions through QRIS will not be subject to VAT

Baznas Chair Says 12 Percent VAT Increase Will Not Affect Zakat Receipts

18 jam lalu

The National Zakat Agency of the Republic of Indonesia (Baznas RI) is optimistic that the increase in 12 percent VAT will not affect zakat receipts.

Today's Top 3 News: Celebrate Christmas in Singapore: Festive Events and Attractions

1 hari lalu

Here is the list of the top 3 news on Tempo English today.

Lowest and Highest VAT Rates in the World: Where Does Indonesia Fall?

2 hari lalu

With the rise of Indonesia's VAT rate to 12%, the public began to ask which country has the highest VAT rate in the world. See the full list here.

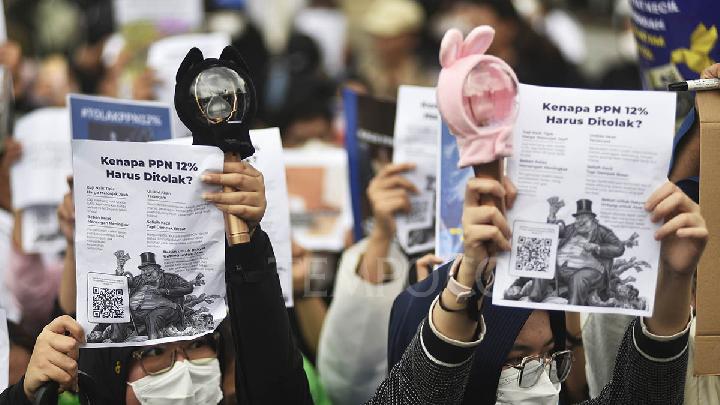

K-Pop Fans Join VAT Hike Protests, Fear of Rising Concert Prices

3 hari lalu

Young people across various groups including K-pop fans expressed their opposition to the 12% VAT rate through protests and online petitions.

Protesters Submit Online Petition Against 12% VAT Hike

3 hari lalu

The main reason behind the petition is the belief that the 12% VAT increase will place a significant burden on the public.

Indonesian Police Deploying 820 Officers to Secure Protest Against VAT Hike to 12% in Front of State Palace

3 hari lalu

The Indonesian Police have deployed at least 820 combined personnel to secure a protest against the 12-percent VAT hike at the Presidential Palace.

3 months ago

67

3 months ago

67