January 21, 2026 | 09:19 pm

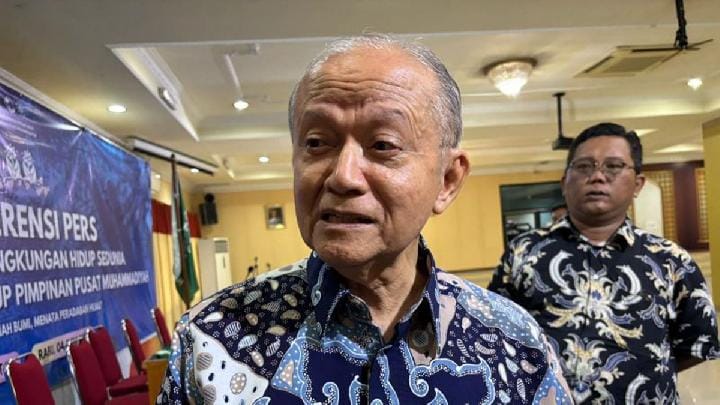

TEMPO.CO, Jakarta - Bank Indonesia (BI) Governor Perry Warjiyo explained the factors causing the rupiah to weaken further and approach Rp17,000 per U.S. dollar. According to Perry, several domestic factors have put pressure on the rupiah, including market perception.

Perry said that market perception of the nomination process for Deputy Governor of BI also adds pressure to the rupiah. "Market perception of the fiscal conditions and also the nomination process of the Deputy Governor, as we emphasized earlier that the nomination process is in accordance with the law and certainly does not affect the implementation of Bank Indonesia's tasks and authorities which remain professional and have strong governance," said Perry in a press conference following the Board of Governors Meeting on Wednesday, January 21, 2026.

The nomination process for the Deputy Governor of BI has attracted attention after President Prabowo Subianto's nephew and Deputy Finance Minister Thomas Djiwandono entered the list of candidates. Two other candidates are Head of the BI Payment System Policy Department Dicky Kartikayono and Head of the BI Macroprudential Policy Department Solikin M. Juhro.

In addition to market perception, Perry also mentioned other domestic factors, namely the outflow of foreign capital from the domestic market. BI noted that as of January 19, 2026, the outflow of foreign capital reached US$1.6 billion. Perry said the outflow of foreign capital was influenced by the significant foreign exchange requirements of several corporations, including Pertamina, PLN, and Danantara.

Perry also mentioned several global factors influencing the rupiah's weakening, such as geopolitical conditions, U.S. tariff policies, and the high U.S. Treasury yield. "In addition, there are other conditions that have caused the dollar to strengthen and a flow of capital to go out from emerging markets to developed countries, including the United States," he said.

Pressure on the rupiah that has been occurring since the end of 2025 has increased at the beginning of 2026. In trading on Wednesday, January 21, 2026, the rupiah closed at Rp16,936 per U.S. dollar.

Economist from the Institute for Economic and Social Research, Faculty of Economics and Business, University of Indonesia (LPEM FEB UI) Teuku Riefky assessed that the nomination of Thomas Djiwandono will have an impact on the pressure experienced by the rupiah. He also said that it's only a matter of time before the rupiah breaks through the psychological barrier of Rp17,000 per U.S. dollar.

According to Riefky, this is a bad precedent, because Indonesia is currently not in a crisis, but all economic indicators are worsening. "This is what worries me. It may be that the policy-making process is causing investors to not see us as a healthy economy," he said at the Centre for Strategic and International Studies office in Jakarta on Tuesday, January 20, 2026.

Read: Bank Indonesia Holds Interest Rate at 4.75% as Rupiah Tumbles

Click here to get the latest news updates from Tempo on Google News

Weakening Rupiah Not Expected to Impact 2026 Hajj Fees

4 jam lalu

The government claims that the fluctuation in the exchange rate has been anticipated from the beginning by the Hajj Fund Management Agency (BPKH).

Bank Indonesia Holds Interest Rate at 4.75% as Rupiah Tumbles

5 jam lalu

Bank Indonesia keeps the deposit facility interest rate at 3.75 percent and the lending facility interest rate at 5.50 percent.

Rupiah Nears Rp17,000 per USD: LPEM UI Notes 3 Factors

6 jam lalu

The rupiah exchange rate plunged to Rp16,956 per US dollar at the close of trading yesterday, January 21, 2026.

Rupiah Could Strengthen If There Is Certainty About Policy Direction, Says Economist

9 jam lalu

Indonesian gov't should restore market confidence through certainty of policy direction as it will encourage the strengthening of rupiah exchange rate

Batam Sees Influx of Singapore and Malaysia Shoppers

11 jam lalu

In recent months, the number of foreign tourists from Singapore and Malaysia visiting Batam City, Riau Islands Province, Indonesia, has increased.

Today's Top 3 News: Purbaya's Confidence in Rupiah's Recovery, Facts About the ATR 42-500 Aircraft Crash

1 hari lalu

Here is the list of the top 3 news on Tempo English today.

Indonesia's Purbaya Attributes IHSG Gains to Foreign Investment Inflow

1 hari lalu

ndonesia's Minister of Finance, Purbaya Yudhi Sadewa, said foreign investments influenced the strengthening of IDX Composite Index (IHSG).

Indonesia's Purbaya Confident Rupiah Will Regain Strength Over Time

1 hari lalu

Finance Minister Purbaya Yudhi Sadewa says the rupiah will strengthen over time, supported by economic fundamentals and government measures.

Analyst: Rupiah May See Limited Gains Amid US Tariff Risks

2 hari lalu

Currency analyst Lukman Leong predicts the rupiah could see limited gain due to the impact of potential new US tariffs.

IHSG Expected to Climb as Investors Wary of Rupiah Depreciation

3 hari lalu

The weakening rupiah is predicted to drive uncertainty among investors, which indirectly affects the sentiment towards IHSG.