December 22, 2024 | 04:08 pm

TEMPO.CO, Jakarta - The National Zakat Agency of the Republic of Indonesia (Baznas RI) is optimistic that the increase in the Value-Added Tax rate, aka VAT, of 12 percent will not affect zakat receipts.

Quoted from Antaranews, the Chair of Baznas RI, Noor Achmad, stated that the spiritual strength of the Indonesian people is the main reason for this belief.

"I suspect that the Indonesian people are not affected by these conditions. The Indonesian people have strength in the religious field," said Noor Achmad in Bandung, Wednesday, December 18, 2024 as quoted from Antaranews.

Noor gave an example of the experience during the COVID-19 pandemic, when concerns about a decrease in zakat, infaq, and sedekah (ZIS) receipts were proven wrong. "COVID-19 actually increased ZIS receipts," he said.

He added that zakat, infaq, and sedekah are forms of religious charity that are not easily disturbed by economic policies or social dynamics. Noor also believes that the potential decline in the middle class will not have a significant impact on ZIS collection.

"People say the middle class is declining and it is feared that ZIS revenues will decline. We feel that there is such a problem, but we have never been bothered by such things," said Noor.

Baznas RI is targeting ZIS collection of Rp41 trillion by the end of 2024. To date, the institution has collected around Rp30 trillion, with reports of collection from various regions still ongoing.

"National collection from all regions to date is Rp30 trillion. Our target is Rp41 trillion, but only Rp31 trillion has been reported to us. To date, reports are still ongoing. Maybe all reports will have been collected by early 2025," said Noor Achmad.

The 12 percent increase in VAT rates which will take effect on January 1, 2025, as stipulated in the Law on Harmonization of Tax Regulations, still provides VAT exemption facilities for a number of basic necessities.

Coordinating Minister for the Economy, Airlangga Hartarto, explained that strategic goods such as rice, broiler chicken, fish, chilies, shallots, and granulated sugar will remain VAT-free. As for certain basic necessities such as wheat flour, Minyakita, and industrial sugar, a 1 percent Government-borne VAT (DTP) facility is provided, so that the VAT rate remains at 11 percent.

"This stimulus is to maintain people's purchasing power, especially for basic needs," said Airlangga in a press conference in Jakarta, Monday, December 16, 2024. The government is also providing food assistance in the form of 10 kilograms of rice per month for families in deciles 1 and 2.

With this policy, the government hopes that the impact of the 12 percent VAT rate increase on the community can be minimized, while Baznas remains optimistic about the commitment of the Indonesian people to distribute zakat as a form of social solidarity.

Source: Antaranews

Editor’s Choice: K-Pop Fans Join VAT Hike Protests, Fear of Rising Concert Prices

Click here to get the latest news updates from Tempo on Google News

Today's Top 3 News: Celebrate Christmas in Singapore: Festive Events and Attractions

19 jam lalu

Here is the list of the top 3 news on Tempo English today.

Lowest and Highest VAT Rates in the World: Where Does Indonesia Fall?

1 hari lalu

With the rise of Indonesia's VAT rate to 12%, the public began to ask which country has the highest VAT rate in the world. See the full list here.

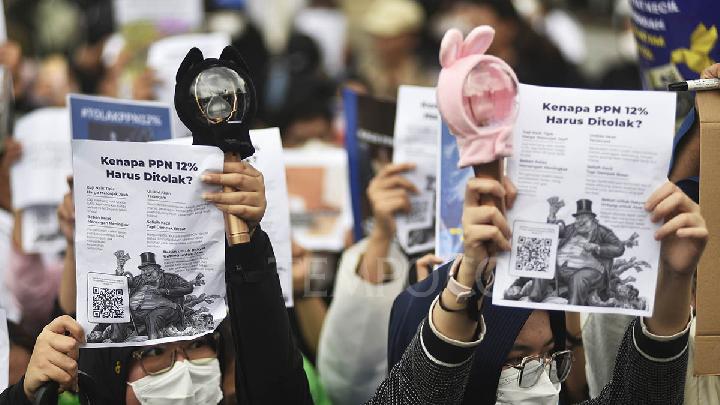

K-Pop Fans Join VAT Hike Protests, Fear of Rising Concert Prices

2 hari lalu

Young people across various groups including K-pop fans expressed their opposition to the 12% VAT rate through protests and online petitions.

Protesters Submit Online Petition Against 12% VAT Hike

2 hari lalu

The main reason behind the petition is the belief that the 12% VAT increase will place a significant burden on the public.

Indonesian Police Deploying 820 Officers to Secure Protest Against VAT Hike to 12% in Front of State Palace

3 hari lalu

The Indonesian Police have deployed at least 820 combined personnel to secure a protest against the 12-percent VAT hike at the Presidential Palace.

99,000 People Sign Petition Urging Prabowo to Cancel the 12 Percent VAT

3 hari lalu

A total of 99,098 people have signed a petition addressed to Indonesian President Prabowo Subianto to cancel the 12 percent VAT.

Over 65,000 People Sign Online Petition Against Indonesia's VAT Hike

3 hari lalu

Minister Airlangga Hartarto said that the 12 percent VAT increase is not determined by the government.

Food Agency Denies Premium Rice Subject to 12% VAT

3 hari lalu

The National Food Agency (Bapanas) Head Arief Prasetyo Adi has refuted claims that premium rice will be subject to the 12% value-added tax (VAT).

List of Goods and Services Affected by the 12 Percent VAT Increase as of January 1, 2025

4 hari lalu

The government will increase VAT by 12 percent as of January 1, 2025. Here's a list of goods and services that will be affected.

Sri Mulyani Says Indonesia's VAT Rate Relatively Low Compared to Other Countries

5 hari lalu

Finance Minister Sri Mulyani Indrawati said that Indonesia's VAT rate remains relatively low compared to other countries.

3 months ago

81

3 months ago

81