December 22, 2024 | 09:12 pm

TEMPO.CO, Jakarta - The Indonesian government has finally acknowledged that the increase in Value-Added Tax (VAT) next year will not be selectively applied only to luxury goods. According to the Director of Counseling, Services, and Public Relations of the Directorate General of Taxes of the Ministry of Finance (Ditjen Pajak Kemenkeu), Dwi Astuti, 12 percent VAT will be imposed on almost all existing goods and services.

"(12 percent VAT) applies to all goods and services that have been subject to a rate of 11 percent," said Dwi in a written statement, Saturday, December 21, 2024.

Dwi said that the exception to the VAT increase would only be applied to three types of commodity goods, namely wheat flour, industrial sugar, and Minyakita bulk cooking oil. All three, said Dwi, will be borne by the government for their tax increases. So that people will still pay VAT for the three goods of 11 percent.

"For these three types of goods, the additional VAT of 1 percent will be borne by the government or DTP, so that this VAT rate adjustment does not affect the prices of the three goods," he said.

Meanwhile, the price of basic goods is also confirmed to remain exempt from VAT. This provision is in accordance with Law Number 42 of 2009 concerning VAT. Where basic necessities such as rice, grain, corn, sago, soybeans, salt, meat, eggs, milk, fruits, and vegetables will not be subject to VAT.

Likewise, several services related to the interests of the general public will be given 0 percent VAT. Some of these include medical health services, social services, financial services, insurance services, education services, public transportation services on land and water, labor services and rental services for public flats and public houses.

"Thus, the less fortunate or disadvantaged community is already very protected with these various facilities," said Dwi.

Director of Public Policy Center of Economic and Law Studies (CELIOS), Media Wahyudi Askar, the list of tax-free goods mentioned is basically a category that has been regulated for a long time, and is not something new. Among them are the basic ingredients mentioned by Finance Minister Sri Mulyani such as rice, meat, fish, eggs, and vegetables.

"It's as if the narrative is that the government is providing incentives for basic goods that will not be subject to VAT. In fact, the VAT exemption for basic goods is already in Law 42 of 2009," he said.

Editor’s Choice: Special Rice to Be Subject to 12 Percent VAT

Click here to get the latest news updates from Tempo on Google News

Special Rice to Be Subject to 12 Percent VAT

2 jam lalu

Special rice is likely to be subject to Value-Added Tax (VAT) of 12 percent starting next year in Indonesia.

QRIS Not Subject to 12 Percent VAT, Says Coordinating Minister

4 jam lalu

Coordinating Minister for Economic Affairs Airlangga Hartarto said that electronic money transactions through QRIS will not be subject to VAT

Baznas Chair Says 12 Percent VAT Increase Will Not Affect Zakat Receipts

5 jam lalu

The National Zakat Agency of the Republic of Indonesia (Baznas RI) is optimistic that the increase in 12 percent VAT will not affect zakat receipts.

Today's Top 3 News: Celebrate Christmas in Singapore: Festive Events and Attractions

1 hari lalu

Here is the list of the top 3 news on Tempo English today.

Lowest and Highest VAT Rates in the World: Where Does Indonesia Fall?

2 hari lalu

With the rise of Indonesia's VAT rate to 12%, the public began to ask which country has the highest VAT rate in the world. See the full list here.

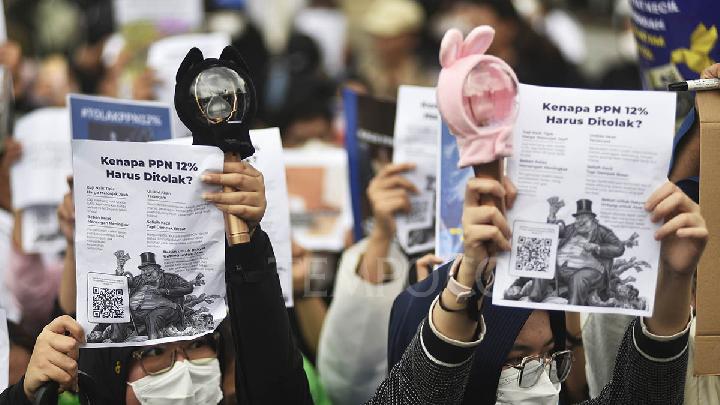

K-Pop Fans Join VAT Hike Protests, Fear of Rising Concert Prices

2 hari lalu

Young people across various groups including K-pop fans expressed their opposition to the 12% VAT rate through protests and online petitions.

Protesters Submit Online Petition Against 12% VAT Hike

3 hari lalu

The main reason behind the petition is the belief that the 12% VAT increase will place a significant burden on the public.

Indonesian Police Deploying 820 Officers to Secure Protest Against VAT Hike to 12% in Front of State Palace

3 hari lalu

The Indonesian Police have deployed at least 820 combined personnel to secure a protest against the 12-percent VAT hike at the Presidential Palace.

99,000 People Sign Petition Urging Prabowo to Cancel the 12 Percent VAT

3 hari lalu

A total of 99,098 people have signed a petition addressed to Indonesian President Prabowo Subianto to cancel the 12 percent VAT.

Over 65,000 People Sign Online Petition Against Indonesia's VAT Hike

4 hari lalu

Minister Airlangga Hartarto said that the 12 percent VAT increase is not determined by the government.

3 months ago

71

3 months ago

71