December 23, 2024 | 11:43 am

TEMPO.CO, Jakarta - Bhima Yudhistira, Executive Director of the Center of Economic and Law Studies (Celios), has disputed the government's assessment of the impact of the upcoming VAT increase from 11% to 12%. While the government anticipates a minimal impact on inflation, with estimates ranging from 0.2% to 1.8%, Celios predicts a significantly higher inflation rate of 4.1%.

“This VAT is imposed in layers, from producers to distributors, so VAT is imposed multiple times up to the final consumer level. So, the final price increase is not simply a direct reflection of the VAT increase,” Bhima told Tempo on Sunday, December 22, 2024.

Bhima's analysis considers several factors, including the increase in the cost of goods sold (HPP) due to the layered impact of the VAT hike and the rising costs of fuel oil (BBM), a critical component in the distribution of goods.

Furthermore, he emphasized that rising production costs, coupled with market expectations of price increases and the weakening of the rupiah, will significantly contribute to increased selling prices. “So the projection of [inflation hike is] 4.1 percent,” said Bhima.

These findings sharply contrast with the government's projections. Febrio Kacaribu, Head of the Fiscal Policy Agency at the Ministry of Finance, expects inflation to increase by only 0.2% to 1.8% due to the VAT increase.

“Current inflation is low at 1.6 percent. The impact of the increase in VAT to 12 percent is 0.2 percent. Inflation will remain low according to the 2025 State Budget target of 1.5 percent to 3.5 percent,” said Febrio in his written statement on Saturday, December 21, 2024.

Similarly, Ferry Irawan, Deputy for Coordination of Management and Development of State-Owned Enterprises at the Coordinating Ministry for Economic Affairs, predicted a modest 0.3% inflation increase due to the VAT hike. “It's minimal, relatively small,” Ferry said at the office of the Coordinating Ministry for Economic Affairs, Jakarta, Tuesday, December 17, 2024.

Dwi Astuti, Director of Counseling, Services, and Public Relations at the Directorate General of Taxes, also downplayed the impact of the VAT increase, stating that it would only result in a 0.9% price increase for consumers.

Ilona Estherina contributed to the writing of this article.

Editor’s Choice: PDIP Denies Being Initiator of 12 Percent VAT: 'Jokowi Govt Proposed It'

Click here to get the latest news updates from Tempo on Google News

PDIP Criticizes 12 Percent VAT, Gerindra: Should Declare Themselves as Opposition

2 jam lalu

Gerindra party says that PDIP does not need to play drama by pretending to defend people over the increase in value-added tax (VAT) to 12 percent.

PDIP Denies Being Initiator of 12 Percent VAT: 'Jokowi Govt Proposed It'

13 jam lalu

The PDIP party denied allegations that the party faction proposed an increase in value-added tax (VAT) to 12 percent.

Director General of Taxes Says 12 Percent VAT Imposed on Some Goods and Services

15 jam lalu

The Indonesian govt has finally acknowledged that the increase in Value Added Tax (VAT) next year will not be selectively applied only to luxury goods

Special Rice to Be Subject to 12 Percent VAT

17 jam lalu

Special rice is likely to be subject to Value-Added Tax (VAT) of 12 percent starting next year in Indonesia.

QRIS Not Subject to 12 Percent VAT, Says Coordinating Minister

19 jam lalu

Coordinating Minister for Economic Affairs Airlangga Hartarto said that electronic money transactions through QRIS will not be subject to VAT

Baznas Chair Says 12 Percent VAT Increase Will Not Affect Zakat Receipts

20 jam lalu

The National Zakat Agency of the Republic of Indonesia (Baznas RI) is optimistic that the increase in 12 percent VAT will not affect zakat receipts.

Today's Top 3 News: Celebrate Christmas in Singapore: Festive Events and Attractions

1 hari lalu

Here is the list of the top 3 news on Tempo English today.

Lowest and Highest VAT Rates in the World: Where Does Indonesia Fall?

2 hari lalu

With the rise of Indonesia's VAT rate to 12%, the public began to ask which country has the highest VAT rate in the world. See the full list here.

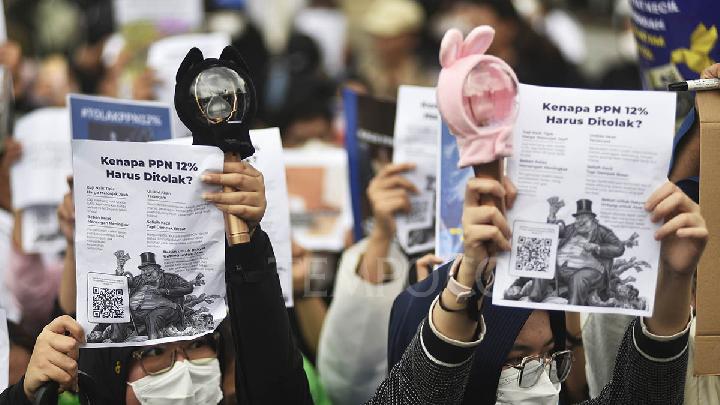

K-Pop Fans Join VAT Hike Protests, Fear of Rising Concert Prices

3 hari lalu

Young people across various groups including K-pop fans expressed their opposition to the 12% VAT rate through protests and online petitions.

Protesters Submit Online Petition Against 12% VAT Hike

3 hari lalu

The main reason behind the petition is the belief that the 12% VAT increase will place a significant burden on the public.

3 months ago

76

3 months ago

76