December 22, 2024 | 11:14 pm

TEMPO.CO, Jakarta - PDIP DPP Chair, Deddy Yevri Sitorus, denied allegations that his party faction proposed an increase in value-added tax (VAT) to 12 percent. He said that the increase in the VAT rate from 11 percent to 12 percent through the ratification of Law Number 7 of 2021 concerning the Harmonization of Tax Regulations (HPP) was not based on the PDIP faction's initiative.

He stated that the discussion of the law was previously proposed by the Joko Widodo government in the previous period. PDIP, he said, as a faction involved in the discussion, was then appointed as Chair of the Working Committee or Panja.

"So, it is wrong to say that the initiator was PDI Perjuangan (PDIP), because the one who proposed the increase was the government and through the Ministry of Finance," said Deddy in a written statement, on Sunday, December 22, 2024.

He explained that at that time, the law was approved with the assumption that the economic conditions in Indonesia and the world were in good condition. However, Deddy said, over time, there were a number of conditions that made many parties, including PDIP, request that the implementation of the VAT increase to 12 percent be reviewed.

For example, such as the people's purchasing power which has slumped and the storm of layoffs in a number of regions. In addition, the rupiah exchange rate against the US dollar which is currently continuing to weaken. The request, said Deddy, does not mean that the PDIP faction rejects the VAT to 12 percent.

"So, it is not at all blaming the Prabowo government, no, because that was given from the previous period's agreement," he said.

Previously, the Gerindra Party faction of the DPR said that PDIP was like throwing stones and hiding their hands when taking a stance on the VAT increase. "PDIP continues to seek the sympathy of the people, but they forget that they were the ones who proposed the 12 percent VAT increase," said a member of the Gerindra Party faction of the DPR, Bahtra Banong, in a written statement on Saturday, December 21, 2024, as quoted by Antara.

He said that the Chairperson of the Working Committee regarding the 12 percent VAT increase at that time was a PDIP cadre and also Deputy Chairperson of Commission XI of the DPR, namely Dolfie Othniel. Therefore, he considered that the PDIP's current stance regarding the VAT increase was something that was not appropriate to be shown to the public.

"They asked to cancel it, even though they proposed it and even the chairperson of the working committee was their cadre. Why are they rejecting it now?" he said.

According to Bahtra, the PDIP should appreciate Prabowo. The reason is, Prabowo dared to take responsibility for implementing the 12 percent VAT policy.

Editor’s Choice: Director General of Taxes Says 12 Percent VAT Imposed on Some Goods and Services

Click here to get the latest news updates from Tempo on Google News

Director General of Taxes Says 12 Percent VAT Imposed on Some Goods and Services

2 jam lalu

The Indonesian govt has finally acknowledged that the increase in Value Added Tax (VAT) next year will not be selectively applied only to luxury goods

Special Rice to Be Subject to 12 Percent VAT

4 jam lalu

Special rice is likely to be subject to Value-Added Tax (VAT) of 12 percent starting next year in Indonesia.

QRIS Not Subject to 12 Percent VAT, Says Coordinating Minister

6 jam lalu

Coordinating Minister for Economic Affairs Airlangga Hartarto said that electronic money transactions through QRIS will not be subject to VAT

Baznas Chair Says 12 Percent VAT Increase Will Not Affect Zakat Receipts

7 jam lalu

The National Zakat Agency of the Republic of Indonesia (Baznas RI) is optimistic that the increase in 12 percent VAT will not affect zakat receipts.

Today's Top 3 News: Celebrate Christmas in Singapore: Festive Events and Attractions

1 hari lalu

Here is the list of the top 3 news on Tempo English today.

Lowest and Highest VAT Rates in the World: Where Does Indonesia Fall?

2 hari lalu

With the rise of Indonesia's VAT rate to 12%, the public began to ask which country has the highest VAT rate in the world. See the full list here.

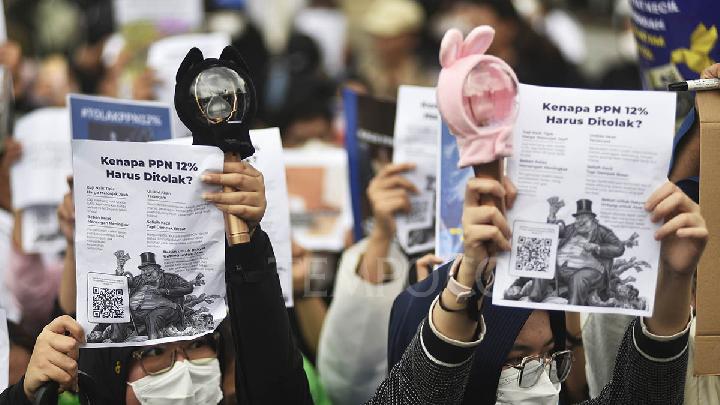

K-Pop Fans Join VAT Hike Protests, Fear of Rising Concert Prices

3 hari lalu

Young people across various groups including K-pop fans expressed their opposition to the 12% VAT rate through protests and online petitions.

Protesters Submit Online Petition Against 12% VAT Hike

3 hari lalu

The main reason behind the petition is the belief that the 12% VAT increase will place a significant burden on the public.

Indonesian Police Deploying 820 Officers to Secure Protest Against VAT Hike to 12% in Front of State Palace

3 hari lalu

The Indonesian Police have deployed at least 820 combined personnel to secure a protest against the 12-percent VAT hike at the Presidential Palace.

99,000 People Sign Petition Urging Prabowo to Cancel the 12 Percent VAT

3 hari lalu

A total of 99,098 people have signed a petition addressed to Indonesian President Prabowo Subianto to cancel the 12 percent VAT.

3 months ago

85

3 months ago

85