December 22, 2024 | 05:27 pm

TEMPO.CO, Jakarta - Coordinating Minister for Economic Affairs Airlangga Hartarto said that electronic money transactions through the Quick Response Code Indonesian Standard (QRIS) will not be subject to Value-Added Tax (VAT). According to him, only goods will be subject to the 12 percent tax.

"Payment system, today QRIS is popular, it is also not subject to VAT," Airlangga told reporters in the Tangerang area, Banten, Sunday, December 22, 2024.

Not only QRIS, Airlangga said, transactions via debit and other cards will also not be subject to VAT. The same applies to the transportation, health, and education sectors. Exceptions are given for special matters that will be determined by the government later.

Airlangga asked the public not to analyze various matters regarding electronic money transactions. He admitted that he read the analysis that QRIS would be subject to VAT in the media. What will be taxed, he said, is only goods, not transactions. "This is called a fried business," said the former General Chairperson of the Golkar Party.

The Directorate General of Taxes of the Ministry of Finance (Kemenkeu) previously explained that goods and services would start to be subject to 12 percent VAT on January 1, 2024, such as services for electronic money transactions and digital wallets. QRIS payment services will also be subject to 12 percent VAT collected by service providers from merchant owners.

In addition, subscription fees for digital platforms, such as Netflix, Spotify, Youtube Premium, and so on are objects of VAT. Sales of credit, starter cards, tokens, and vouchers have also been subject to VAT.

Domestic flight ticket sales transactions will also be subject to tax. The DJP explained that all of the goods and services mentioned are indeed not objects of the new value added tax imposed, but are indeed goods subject to VAT. So starting next year, the VAT rate is certain to follow the new rules, namely 12 percent.

The government also determines groups of goods that are exempt from VAT, such as basic necessities, including basic necessities, namely rice, grain, corn, sago, soybeans, salt, meat, eggs, milk, fruits, and vegetables. Meanwhile, services that are exempt from VAT include medical health services, social services, financial services, insurance services, education services and public transportation.

Meanwhile, goods with a fixed VAT rate or 11 percent are MinyaKita cooking oil, wheat flour, and industrial sugar.

Ilona Estherina contributed to the writing of this article.

Editor’s Choice: Baznas Chair Says 12 Percent VAT Increase Will Not Affect Zakat Receipts

Click here to get the latest news updates from Tempo on Google News

Baznas Chair Says 12 Percent VAT Increase Will Not Affect Zakat Receipts

1 jam lalu

The National Zakat Agency of the Republic of Indonesia (Baznas RI) is optimistic that the increase in 12 percent VAT will not affect zakat receipts.

Today's Top 3 News: Celebrate Christmas in Singapore: Festive Events and Attractions

20 jam lalu

Here is the list of the top 3 news on Tempo English today.

Lowest and Highest VAT Rates in the World: Where Does Indonesia Fall?

1 hari lalu

With the rise of Indonesia's VAT rate to 12%, the public began to ask which country has the highest VAT rate in the world. See the full list here.

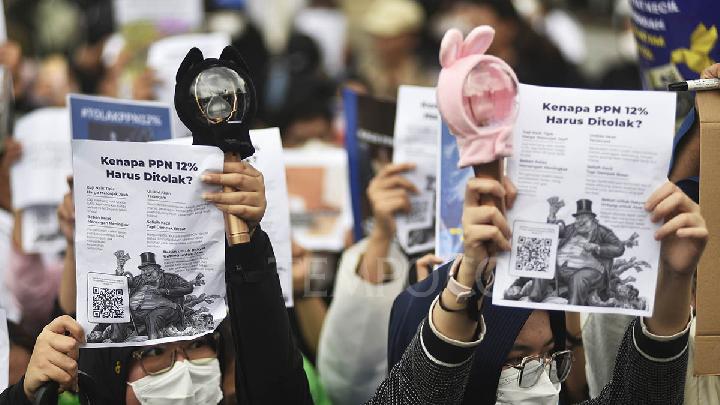

K-Pop Fans Join VAT Hike Protests, Fear of Rising Concert Prices

2 hari lalu

Young people across various groups including K-pop fans expressed their opposition to the 12% VAT rate through protests and online petitions.

Protesters Submit Online Petition Against 12% VAT Hike

2 hari lalu

The main reason behind the petition is the belief that the 12% VAT increase will place a significant burden on the public.

BI Reports 186% Surge in QRIS Transactions as Debit Card Usage Declines

3 hari lalu

Bank Indonesia will continue to promote the adoption of QRIS. By 2025, BI aims to reach 58 million QRIS users.

Indonesian Police Deploying 820 Officers to Secure Protest Against VAT Hike to 12% in Front of State Palace

3 hari lalu

The Indonesian Police have deployed at least 820 combined personnel to secure a protest against the 12-percent VAT hike at the Presidential Palace.

99,000 People Sign Petition Urging Prabowo to Cancel the 12 Percent VAT

3 hari lalu

A total of 99,098 people have signed a petition addressed to Indonesian President Prabowo Subianto to cancel the 12 percent VAT.

Over 65,000 People Sign Online Petition Against Indonesia's VAT Hike

3 hari lalu

Minister Airlangga Hartarto said that the 12 percent VAT increase is not determined by the government.

Food Agency Denies Premium Rice Subject to 12% VAT

4 hari lalu

The National Food Agency (Bapanas) Head Arief Prasetyo Adi has refuted claims that premium rice will be subject to the 12% value-added tax (VAT).

3 months ago

88

3 months ago

88