December 22, 2024 | 07:09 pm

TEMPO.CO, Jakarta - Special rice is likely to be subject to Value-Added Tax (VAT) of 12 percent starting next year. This is because this rice is different from medium and premium rice which the government exempts from the tax.

"No, special rice is different (from medium and premium rice which are free of VAT). We'll talk about that later," said the Head of the National Food Agency (Bapanas) Arief Prasetyo Adi to reporters in the Tangerang area, Banten, Sunday, December 22, 2024.

Arief revealed that the basic ingredients managed by Bapanas will not be subject to VAT. These basic ingredients include medium and premium rice, ruminant meat, soybeans, shallots, garlic, and chilies.

Meanwhile, special rice is not managed by Bapanas. The institution, which was established in July 2021, only manages medium and premium rice. Therefore, Arief said the government is still discussing whether special rice will be subject to VAT.

"It's like this, if it's meat, regular ruminant meat is okay (VAT-free). But when it comes to wagyu, kobe, and others, yes we have to discuss it," said Arief.

Arief did not elaborate further on what types of rice are included in the special rice. However, based on the National Food Agency (Bapanas) Regulation Number 2 of 2023, special rice includes glutinous rice, red rice, black rice, and local varieties of rice.

Special rice also includes fortified rice, organic rice, geographically indicated rice, rice with health claims and certain rice that cannot be produced domestically. Meanwhile, general rice includes brown rice and milled rice.

Premium rice was previously included in the list of luxury goods that would be subject to a 12 percent VAT cut. However, Arief ensured that currently there is no type of rice that has been determined by the government to be subject to the tax increase.

"Yes, the point is that now there is no (type of rice) that is subject to VAT. "Currently, none of these commodities are subject to VAT, not yet," he said when contacted by Tempo on Thursday, December 19, 2024.

Bapanas is currently still discussing the issue of special rice which will likely become a type of rice subject to 12 percent VAT. However, Arief said that the special rice he meant was the type of special rice imported and not special rice produced domestically.

"Imported special rice, that's my suggestion, that's all if VAT is to be imposed," he said. The government's goal, he said, is to encourage domestic production in order to maintain the stability of food stocks to meet national needs. "For special rice produced domestically, let's not do it yet, because we still have a rice shortage," he added.

Hanin Marwah contributed to the writing of this article.

Editor’s Choice: Baznas Chair Says 12 Percent VAT Increase Will Not Affect Zakat Receipts

Click here to get the latest news updates from Tempo on Google News

QRIS Not Subject to 12 Percent VAT, Says Coordinating Minister

2 jam lalu

Coordinating Minister for Economic Affairs Airlangga Hartarto said that electronic money transactions through QRIS will not be subject to VAT

Baznas Chair Says 12 Percent VAT Increase Will Not Affect Zakat Receipts

3 jam lalu

The National Zakat Agency of the Republic of Indonesia (Baznas RI) is optimistic that the increase in 12 percent VAT will not affect zakat receipts.

Today's Top 3 News: Celebrate Christmas in Singapore: Festive Events and Attractions

22 jam lalu

Here is the list of the top 3 news on Tempo English today.

Lowest and Highest VAT Rates in the World: Where Does Indonesia Fall?

1 hari lalu

With the rise of Indonesia's VAT rate to 12%, the public began to ask which country has the highest VAT rate in the world. See the full list here.

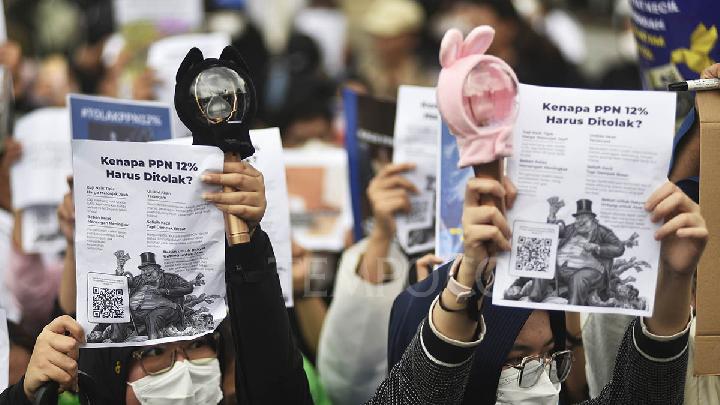

K-Pop Fans Join VAT Hike Protests, Fear of Rising Concert Prices

2 hari lalu

Young people across various groups including K-pop fans expressed their opposition to the 12% VAT rate through protests and online petitions.

Protesters Submit Online Petition Against 12% VAT Hike

2 hari lalu

The main reason behind the petition is the belief that the 12% VAT increase will place a significant burden on the public.

Indonesian Police Deploying 820 Officers to Secure Protest Against VAT Hike to 12% in Front of State Palace

3 hari lalu

The Indonesian Police have deployed at least 820 combined personnel to secure a protest against the 12-percent VAT hike at the Presidential Palace.

99,000 People Sign Petition Urging Prabowo to Cancel the 12 Percent VAT

3 hari lalu

A total of 99,098 people have signed a petition addressed to Indonesian President Prabowo Subianto to cancel the 12 percent VAT.

Over 65,000 People Sign Online Petition Against Indonesia's VAT Hike

3 hari lalu

Minister Airlangga Hartarto said that the 12 percent VAT increase is not determined by the government.

Food Agency Denies Premium Rice Subject to 12% VAT

4 hari lalu

The National Food Agency (Bapanas) Head Arief Prasetyo Adi has refuted claims that premium rice will be subject to the 12% value-added tax (VAT).

3 months ago

97

3 months ago

97