December 14, 2024 | 02:31 pm

TEMPO.CO, Jakarta - PT Laba Forexindo Berjangka Director Ibrahim Assuaibi has urged the government to consider the macroeconomic impact of raising the Value-Added Tax (VAT) to 12%. While the policy could generate an estimated IDR 75 trillion annually, Ibrahim warned it may lead to a surge in inflation when implemented at the beginning of next year.

“For instance, in 2022, when VAT increased to 11%, inflation rose by 0.95% in just one month. A similar, if not larger, impact is likely,” Ibrahim said in a written statement released Friday.

Finance Minister Sri Mulyani recently reported Indonesia's annual inflation rate for November at 1.55%, a level she described as favorable. She emphasized the government’s focus on maintaining purchasing power by preventing excessive price hikes.

“This is a positive outcome aligned with our goal of preserving purchasing power and ensuring it is not eroded by rising prices,” Sri Mulyani said during the APBN KITA press conference at the Ministry of Finance on Wednesday, Dec. 11.

Ibrahim also highlighted concerns over the potential strain on household spending from the VAT increase. Economists, he noted, have warned of a possible "crowding-out effect," where central and local governments compete for public funds in the consumption and investment sectors.

“The middle-class purchasing power is likely to come under pressure, potentially leading to a decline in household consumption, which is the primary driver of economic growth,” Ibrahim stated.

To mitigate these risks, Ibrahim emphasized the importance of appropriately allocating the additional revenue from the VAT hike. He suggested directing the funds toward public welfare programs such as healthcare subsidies, education, and basic infrastructure development.

Coordinating Minister for Economic Affairs Airlangga Hartarto announced that the government is finalizing details of the VAT increase, which will take effect no later than Jan. 1, 2025.

When asked if the 12% VAT policy would be finalized this week, Airlangga said, “Yes, hopefully, we can wrap it up.” He made the remarks during a media briefing at the Coordinating Ministry for Economic Affairs in Central Jakarta on Friday.

As of now, Airlangga declined to disclose which luxury goods will be affected by the policy, stating, “Wait for the meeting. No leaks.” He referred to a scheduled discussion with other ministers at the Merdeka Palace later that day.

HANIN MARWAH I NABILA AZZAHRA

Click here to get the latest news updates from Tempo on Google News

Sri Mulyani Assures Basic Necessities Exempted from 12% VAT

2 hari lalu

Finance Minister Sri Mulyani ensured that the increase in VAT to 12 percent will not be imposed on essential goods.

12% VAT to Affect Car Sales Next Year, Industry Ministry Says

2 hari lalu

Director General Reni Yanita admitted she could not yet confirm which cars would be subject to the VAT hike.

Today's Top 3 News: Indonesia Secures First Win in 2024 AFF Cup After 1-0 Match Against Myanmar

3 hari lalu

Here is the list of the top 3 news on Tempo English today.

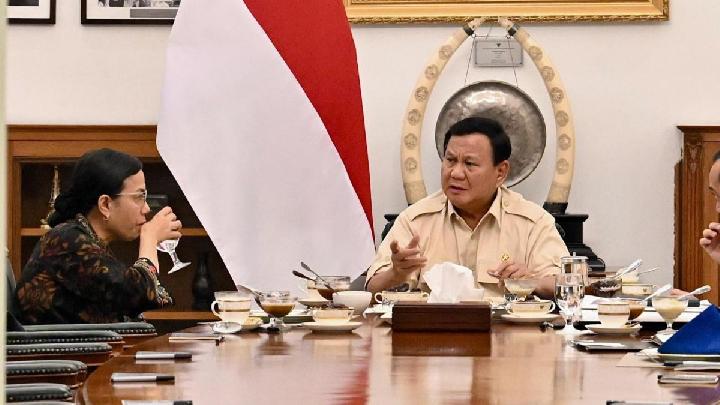

Prabowo Decides 12 Percent VAT to be Selective, Indonesia's Tax is Highest in ASEAN

4 hari lalu

After implementing a 12 percent VAT, Indonesia is now on par with the Philippines, both imposing a 12 percent value-added tax.

Finance Ministry: Luxury Goods Subjected to 12 Percent VAT Still Under Discussion

6 hari lalu

The Finance Ministry is still compiling a list of luxury goods to be subjected to 12 percent VAT next year.

Prabowo to Increase VAT for Luxury Goods in 2025

6 hari lalu

President Prabowo will be increasing VAT for luxury goods next year as the government sets new targets.

Prabowo Says 12 Percent VAT to Be Applied Selectively Next Year

7 hari lalu

President Prabowo ensures that VAT increase will be implemented in accordance with the law starting in January 2025, for luxury goods.

Today's Top 3 News: Prabowo Approves VAT Hike to 12% Next Year but Only for Luxury Goods

7 hari lalu

Here is the list of the top 3 news on Tempo English today.

Prabowo Approves VAT Hike to 12% Next Year but Only for Luxury Goods

8 hari lalu

Indonesian President Prabowo Subianto has approved a limited increase in Value Added Tax (VAT) from 11% to 12%.

Sri Mulyani Remains Silent on VAT

9 hari lalu

Sri Mulyani is reluctant to comment on the VAT increase, but her subordinates indicate that the tax hike will remain unchanged.

3 months ago

67

3 months ago

67