December 14, 2024 | 04:55 pm

TEMPO.CO, Jakarta - The Financial Services Authority (OJK) revealed the potential impact of increasing the value-added tax (VAT) to 12 percent on banking. OJK's Chief Executive of Banking Supervision Dian Ediana Rae, said that the policy could lead to an economic contraction.

According to Dian, it cannot be denied that increasing the VAT to 12 percent has the potential to affect people's purchasing power. Meanwhile, from the supply side, the policy is considered to gradually affect production costs and quality of goods. This is done by business actors to ensure that products and services remain attractive to buyers.

"This adjustment condition has the potential to create a temporary contraction in economic activity," she said during a press conference on Friday, December 13, 2024.

Such condition however, is not considered to have direct implications on debtors' payment abilities. Dian stated that FSA, together with other regulators, will monitor economic indicators to promote growth and economic stability.

The 12 percent VAT rate increase will take effect at the latest on January 1, 2025, as stipulated in Article 7 Paragraph (1) of the Harmonization of Tax Regulations Law Number 7 of 2021 (UU HPP). Meanwhile, the rate of 11 percent has been in effect since April 1, 2022.

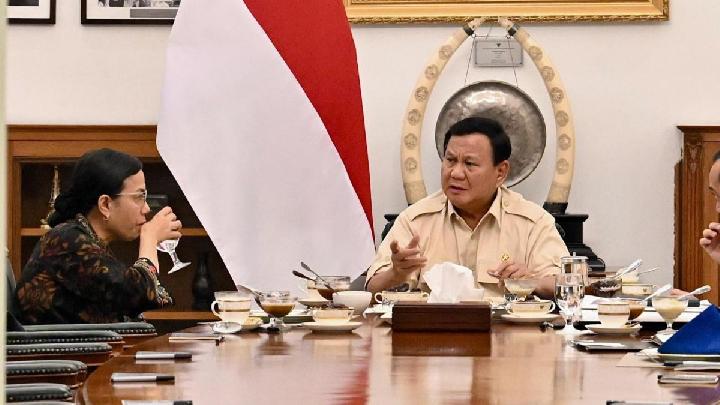

President Prabowo Subianto announced that the 12 percent VAT rate will selectively apply only to luxury goods. This decision was made following Finance Minister Sri Mulyani's announcement to increase VAT rates, which garnered widespread criticism from the public, entrepreneurs, and economists.

Sri Mulyani then ensured that the 12 percent VAT rate would not apply to goods that are basic necessities for people. Further clarification on the 12 percent VAT will be announced by the government on Monday, December 16, 2024.

In terms of banking, credit still experienced double-digit growth at 10.92 percent year-on-year (yoy) as of October 2024. Dian noted that when VAT increased from 10 percent to 11 percent in 2022, bank credit could still grow by 10.38 percent yoy with a Non-Performing Loan (NPL) level at 2.19 percent.

NABILLA AZZAHRA

Editor's Choice: Sri Mulyani Assures Basic Necessities Exempted from 12% VAT

Click here to get the latest news updates from Tempo on Google News

PT Laba Forexindo Berjangka Warns of Economic Risks from 12% VAT Increase

3 jam lalu

Laba Forexindo Berjangka Director Ibrahim Assuaibi urged the government to consider the economic impact of raising the Value-Added Tax (VAT) to 12%.

Sri Mulyani Assures Basic Necessities Exempted from 12% VAT

2 hari lalu

Finance Minister Sri Mulyani ensured that the increase in VAT to 12 percent will not be imposed on essential goods.

Bank Muamalat Holds Extraordinary General Meeting of Shareholders, Appoints New President Director and Plans Business Refocusing

2 hari lalu

Bank Muamalat appoints a new president director and emphasizes plans for business refocusing at the Extraordinary General Meeting of Shareholders (RUPSLB) on Wednesday, December 11, 2024.

OJK Reveals 155,000 Reports of Financial Fraud Using OTP Methodology

2 hari lalu

OJK reveals that there are 155,000 complaints of financial transaction fraud through the modus operandi of OTP requests.

OJK to Supervise Cryptocurrency in January 2025 to Prevent Illegal Financial Transactions

2 hari lalu

Starting January, the digital currency cryptocurrency will be supervised by OJK. This is due to the rampant cases of financial fraud using the modus operandi of requesting OTP codes.

12% VAT to Affect Car Sales Next Year, Industry Ministry Says

2 hari lalu

Director General Reni Yanita admitted she could not yet confirm which cars would be subject to the VAT hike.

Today's Top 3 News: Indonesia Secures First Win in 2024 AFF Cup After 1-0 Match Against Myanmar

3 hari lalu

Here is the list of the top 3 news on Tempo English today.

Prabowo Decides 12 Percent VAT to be Selective, Indonesia's Tax is Highest in ASEAN

4 hari lalu

After implementing a 12 percent VAT, Indonesia is now on par with the Philippines, both imposing a 12 percent value-added tax.

Finance Ministry: Luxury Goods Subjected to 12 Percent VAT Still Under Discussion

6 hari lalu

The Finance Ministry is still compiling a list of luxury goods to be subjected to 12 percent VAT next year.

Prabowo to Increase VAT for Luxury Goods in 2025

6 hari lalu

President Prabowo will be increasing VAT for luxury goods next year as the government sets new targets.

3 months ago

64

3 months ago

64